Our Approach

Our Promise to Business Owners

We’re not just investors — we're fully committed to rolling up our sleeves, relocating, and dedicating 100% of our time and energy to ensure your business thrives. We believe in hands-on leadership, working side by side with your team to preserve and grow what you've built. Alongside this commitment, we promise to prioritize your employees, offer flexible solutions tailored to your needs, and uphold the legacy you've worked so hard to create.

A People-First, Employee Ownership Model

We believe the heart of any great business is its people. At Alpine Vistas Capital, we are dedicated to building a people-first culture where every employee has the opportunity to share in the company’s success. Through our broad employee-ownership model, we ensure that your employees become shareholders in the business, benefiting from its future growth. We are committed to honoring the legacy you’ve built by taking care of your team and fostering a culture of respect, growth, and shared success.

Adaptable and Fair Partnership Structures

We understand that every ownership transition is unique, and we’re committed to creating flexible, customized deal structures that meet your needs. Whether you’re seeking a complete exit or an ongoing partnership, we’ll work with you to ensure the process feels right for you and aligns with your personal and financial goals. Our partnership mindset means we’re in this together, and we aim to create a mutually beneficial outcome where you walk away confident in your decision.

Long-Term Mindset on Legacy Stewardship

Your business is more than just numbers—it’s a legacy. At Alpine Vistas Capital, we’re committed to carrying that legacy forward with a long-term investment horizon. We’re not here for a quick turnaround; we’re focused on building and growing your company across generations. You can trust us to maintain your vision, protect what you’ve built, and ensure the business thrives well into the future, honoring the values and culture that made it great.

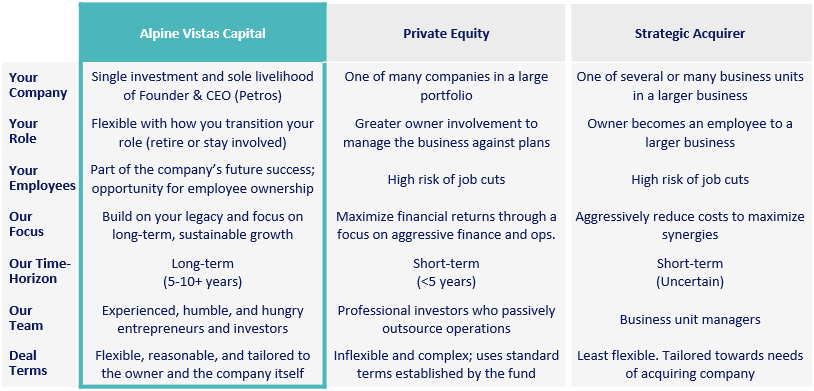

Our Differentiation

Our Process

Sell your business in as short as two months.

-

We'll schedule a 45-minute phone or video call to get to know each other and explore your goals for your business. Rest assured, everything you share will remain confidential. We’re genuinely eager to connect with and learn from successful entrepreneurs.

Goal: Determine if there's a mutual fit and outline possible next steps.

-

During this stage, we’ll focus on gaining a deeper understanding of your business and may request some key data, such as recent financials and major milestones. This information helps us form an initial valuation, and everything shared will be protected under a confidentiality agreement.

This process typically takes 15-45 days.

Goal: Provide a non-binding indication of interest (IOI).

-

We'll arrange an in-person visit to get a deeper understanding of your business, conduct on-site diligence, and walk you through the next steps of the process.

This will take place during the early diligence phase.

Goal: Strengthen our understanding and confirm mutual interest in proceeding with a letter of intent (LOI).

-

We'll work together to finalize the terms of the transaction, aiming to establish a price and structure that works for everyone involved. If appropriate, we'll also explore options like debt and seller financing.

Goal: A signed letter of intent (LOI) and a clear roadmap for the confirmatory diligence process.

-

At this point, we'll bring in advisors like legal and accounting professionals to assist in completing the necessary diligence.

Though this stage can be detailed and time-consuming, we prioritize transparency, clear communication, and understanding throughout the process.

Timeline: Typically lasts around 75 days.

Goal: Complete due diligence, finalize the purchase agreement, and establish a transition plan.

-

At this stage, we’ll sign the final legal agreements, transfer funds to you and any other necessary parties, and celebrate the closing with a well-deserved dinner or event.

Goal: Begin overseeing day-to-day operations and execute the transition plan.

Frequently Asked Questions

-

Unlike selling to traditional private equity firms or family offices, you’ll know exactly who will be stepping in to lead your business and carry forward your legacy. You’ll have the opportunity to get to know me personally and ensure I’m a strong fit for the future of your company. My investors and I are transparent, straightforward, and efficient, able to move faster than the typical private equity firm. Importantly, we won’t need to secure debt to finance the transaction.

-

To determine a fair and market-based valuation, I work closely with my investors and utilize a thorough valuation approach. This typically includes both an EBITDA multiple analysis and a bottom-up Discounted Cash Flow (DCF) analysis. We consider a range of factors that may positively impact the valuation, such as recent company growth, profitability, quality of revenue streams, and overall business size. I’ll ensure complete transparency into how we arrive at the final valuation.

-

Yes, there are a couple of ways for you to remain engaged in the business post-sale:

Equity Ownership: You may choose to retain a portion of your equity (minority) in the business.

Board or Advisory Role: You can also stay involved through a board seat or advisory position, contributing your insight to the ongoing success of the company.

-

I’ve raised capital from a select group of investors who support entrepreneurs like me in finding and acquiring a business. These investors fund my full-time search for up to two years and have the right of first refusal on any acquisition I decide to pursue.

Alpine Vistas Capital’s investor group has extensive experience in Lower Middle Market investments. Their financial strength and expertise allow us to finance and close transactions efficiently and effectively.

-

Yes, absolutely! While many businesses have adopted remote work models post-pandemic, Petros is fully prepared to relocate to wherever the business is based if an on-site presence is essential. For companies with a fully remote team, we’ll collaborate with you to decide the best location for the company’s HQ.

-

Definitely. We know every business is unique!

-

Our goal is to grow the company, largely by retaining the existing team, not to make drastic changes. We aim to acquire a business that’s already working well with the team it has. During the diligence phase, we’ll work closely with you to address any potential cultural or personnel issues early on.

-

We understand the commitment involved and are dedicated to ensuring a smooth process. With timely access to the necessary information, we anticipate the process will take between 2 and 5 months.